Record Retention Requirements For Businesses . Web learn how long to keep different types of records for tax and legal purposes. Web what types of records do businesses need to keep? Web learn how long you should keep your tax records and documents for different situations and purposes. Find sample retention periods for business and. Web how long records should be retained depends on a variety of factors including, but not limited to: Web how long should a company keep its records? The firm's areas of practice, and the. Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. As mandated by iras, your company’s records must be preserved for. The types of records businesses need to keep include: Web document retention guidelines typically require businesses to store records for one, three or seven years.

from www.slideshare.net

Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. Find sample retention periods for business and. Web how long records should be retained depends on a variety of factors including, but not limited to: The types of records businesses need to keep include: Web learn how long to keep different types of records for tax and legal purposes. Web learn how long you should keep your tax records and documents for different situations and purposes. Web document retention guidelines typically require businesses to store records for one, three or seven years. Web what types of records do businesses need to keep? Web how long should a company keep its records? As mandated by iras, your company’s records must be preserved for.

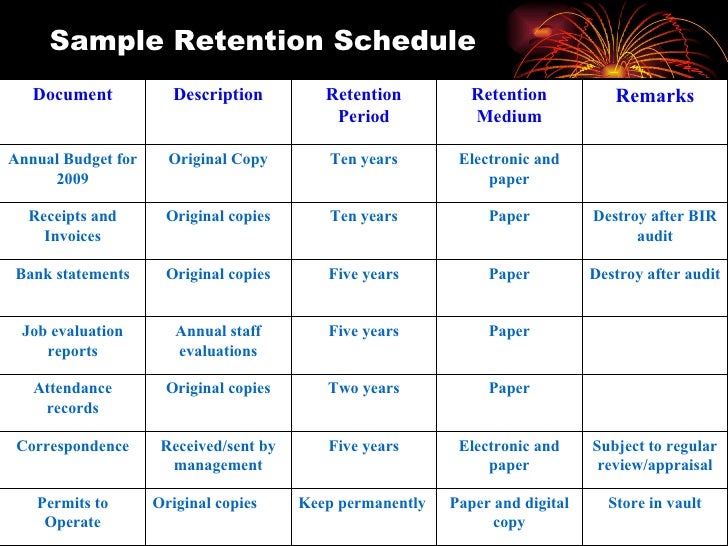

Records Retention Scheduling

Record Retention Requirements For Businesses As mandated by iras, your company’s records must be preserved for. Find sample retention periods for business and. Web document retention guidelines typically require businesses to store records for one, three or seven years. As mandated by iras, your company’s records must be preserved for. The types of records businesses need to keep include: Web how long records should be retained depends on a variety of factors including, but not limited to: Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. Web learn how long to keep different types of records for tax and legal purposes. The firm's areas of practice, and the. Web how long should a company keep its records? Web what types of records do businesses need to keep? Web learn how long you should keep your tax records and documents for different situations and purposes.

From www.ecsfinancial.com

Records Retention What Should You Keep and For How Long? Record Retention Requirements For Businesses Web how long records should be retained depends on a variety of factors including, but not limited to: Web document retention guidelines typically require businesses to store records for one, three or seven years. Find sample retention periods for business and. Web how long should a company keep its records? Web what types of records do businesses need to keep?. Record Retention Requirements For Businesses.

From www.restaurantowner.com

Record Retention Guidelines RestaurantOwner Record Retention Requirements For Businesses Web document retention guidelines typically require businesses to store records for one, three or seven years. Web how long records should be retained depends on a variety of factors including, but not limited to: The firm's areas of practice, and the. Find sample retention periods for business and. Web how long should a company keep its records? Web what types. Record Retention Requirements For Businesses.

From 1sthcc.com

Infographic Federal Record Retention Periods First Healthcare Compliance Record Retention Requirements For Businesses Web how long should a company keep its records? Web learn how long you should keep your tax records and documents for different situations and purposes. Find sample retention periods for business and. As mandated by iras, your company’s records must be preserved for. Web your company must maintain proper records of its financial transactions and retain the source documents,. Record Retention Requirements For Businesses.

From gneil.com

Employee Record Retention Chart Downloadable Record Retention Requirements For Businesses The firm's areas of practice, and the. Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. Web learn how long you should keep your tax records and documents for different situations and purposes. Web how long should a company keep its records? Web what types of records do businesses need to. Record Retention Requirements For Businesses.

From www.jmbfinmgrs.com

Record Retention Guidelines for Business Owners JMB Financial Managers Record Retention Requirements For Businesses The types of records businesses need to keep include: The firm's areas of practice, and the. Web how long records should be retained depends on a variety of factors including, but not limited to: As mandated by iras, your company’s records must be preserved for. Web your company must maintain proper records of its financial transactions and retain the source. Record Retention Requirements For Businesses.

From www.tradepub.com

Record Retention Schedule Guidelines For Every Office Document Free Guide Record Retention Requirements For Businesses Web learn how long to keep different types of records for tax and legal purposes. Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. As mandated by iras, your company’s records must be preserved for. The types of records businesses need to keep include: Web how long records should be retained. Record Retention Requirements For Businesses.

From myexceltemplates123.blogspot.com

Records Retention Schedule Template MS Excel Templates Record Retention Requirements For Businesses As mandated by iras, your company’s records must be preserved for. Web how long records should be retained depends on a variety of factors including, but not limited to: The firm's areas of practice, and the. Find sample retention periods for business and. Web your company must maintain proper records of its financial transactions and retain the source documents, accounting. Record Retention Requirements For Businesses.

From www.augustadatastorage.com

4 Ways to Strengthen Your Records Information Management Practices in Record Retention Requirements For Businesses Web how long records should be retained depends on a variety of factors including, but not limited to: Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. Web learn how long you should keep your tax records and documents for different situations and purposes. Web what types of records do businesses. Record Retention Requirements For Businesses.

From www.rechargecolorado.org

Irs Record Retention Chart Best Picture Of Chart Record Retention Requirements For Businesses Web how long records should be retained depends on a variety of factors including, but not limited to: Web how long should a company keep its records? The firm's areas of practice, and the. As mandated by iras, your company’s records must be preserved for. Web document retention guidelines typically require businesses to store records for one, three or seven. Record Retention Requirements For Businesses.

From didlakeimaging.com

8 Benefits Businesses Get With a Document Retention Policy DDI Record Retention Requirements For Businesses The types of records businesses need to keep include: Find sample retention periods for business and. Web how long should a company keep its records? Web how long records should be retained depends on a variety of factors including, but not limited to: Web learn how long to keep different types of records for tax and legal purposes. Web learn. Record Retention Requirements For Businesses.

From www.recordnations.com

Business Records Retention Times Record Nations Record Retention Requirements For Businesses Web document retention guidelines typically require businesses to store records for one, three or seven years. Web how long should a company keep its records? Find sample retention periods for business and. The types of records businesses need to keep include: Web what types of records do businesses need to keep? Web learn how long you should keep your tax. Record Retention Requirements For Businesses.

From www.laukamcguire.com

Portland Area Certified Public Accountants Records Retention Guidelines Record Retention Requirements For Businesses Find sample retention periods for business and. The firm's areas of practice, and the. Web learn how long to keep different types of records for tax and legal purposes. Web learn how long you should keep your tax records and documents for different situations and purposes. Web what types of records do businesses need to keep? Web document retention guidelines. Record Retention Requirements For Businesses.

From www.shrednations.com

How Long To Retain Your Records Shred Nations Record Retention Requirements For Businesses The firm's areas of practice, and the. Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. Web what types of records do businesses need to keep? Web learn how long you should keep your tax records and documents for different situations and purposes. Find sample retention periods for business and. Web. Record Retention Requirements For Businesses.

From www.sampletemplates.com

13+ Document Retention Policy Samples Sample Templates Record Retention Requirements For Businesses As mandated by iras, your company’s records must be preserved for. Web your company must maintain proper records of its financial transactions and retain the source documents, accounting records. Web how long should a company keep its records? Web learn how long to keep different types of records for tax and legal purposes. Web what types of records do businesses. Record Retention Requirements For Businesses.

From www.tradepub.com

Record Retention Schedule Guidelines For Every Office Document Free Report Record Retention Requirements For Businesses Web document retention guidelines typically require businesses to store records for one, three or seven years. Web how long should a company keep its records? Web learn how long to keep different types of records for tax and legal purposes. The types of records businesses need to keep include: Web learn how long you should keep your tax records and. Record Retention Requirements For Businesses.

From www.recordnations.com

Legal Retention Periods and Guidelines Record Nations Record Retention Requirements For Businesses As mandated by iras, your company’s records must be preserved for. Find sample retention periods for business and. Web how long should a company keep its records? Web learn how long to keep different types of records for tax and legal purposes. The firm's areas of practice, and the. Web document retention guidelines typically require businesses to store records for. Record Retention Requirements For Businesses.

From www.slideshare.net

Records Retention Scheduling Record Retention Requirements For Businesses Web document retention guidelines typically require businesses to store records for one, three or seven years. Web learn how long you should keep your tax records and documents for different situations and purposes. As mandated by iras, your company’s records must be preserved for. Web your company must maintain proper records of its financial transactions and retain the source documents,. Record Retention Requirements For Businesses.

From www.laserfiche.com

What Is Records Retention? Laserfiche Blog Record Retention Requirements For Businesses The types of records businesses need to keep include: Web learn how long you should keep your tax records and documents for different situations and purposes. Web document retention guidelines typically require businesses to store records for one, three or seven years. Web learn how long to keep different types of records for tax and legal purposes. The firm's areas. Record Retention Requirements For Businesses.